|

|||

|

|

|

|

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

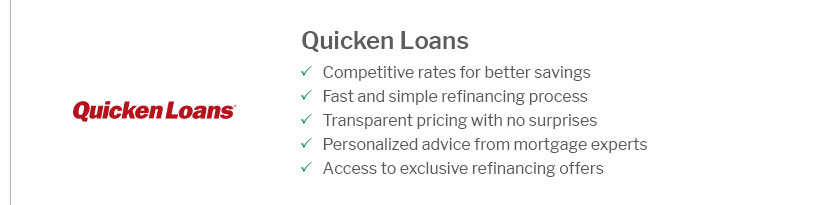

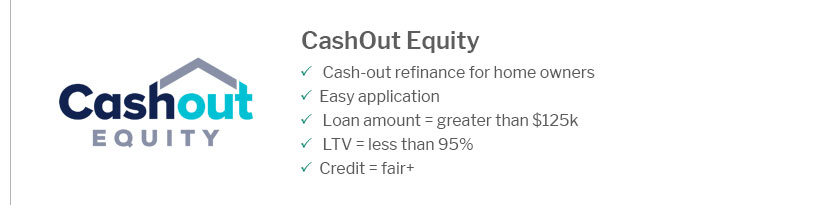

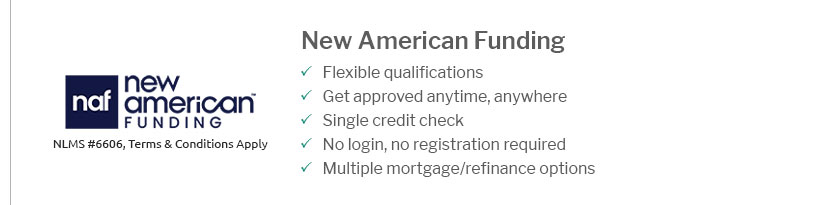

Understanding New Orleans Mortgage Rates: Best Practices for Informed DecisionsNew Orleans, with its vibrant culture and historic charm, offers a unique real estate market that is as captivating as its jazz-filled streets. For those considering planting roots in this iconic city, understanding the intricacies of mortgage rates is crucial. Mortgage rates in New Orleans can vary significantly based on several factors, and making an informed decision requires both knowledge and strategy. Firstly, it’s important to grasp what influences mortgage rates in New Orleans. A multitude of factors play a role, including the Federal Reserve's monetary policy, the overall economic climate, and specific local market conditions. Typically, when the economy is strong, rates tend to rise as the demand for loans increases. Conversely, during economic downturns, rates may fall to stimulate borrowing. Potential homeowners in New Orleans should pay close attention to these economic indicators. Additionally, individual financial health is paramount. Credit scores, debt-to-income ratios, and the size of the down payment can significantly impact the interest rates offered. A higher credit score and a substantial down payment often lead to more favorable terms. Another critical aspect to consider is the type of mortgage. In New Orleans, as in other parts of the country, borrowers can choose between fixed-rate and adjustable-rate mortgages (ARMs). A fixed-rate mortgage offers stability with predictable payments, which is ideal for those planning to stay long-term. In contrast, ARMs may start with lower rates, appealing to those who expect to relocate or refinance before the rates adjust. When navigating the mortgage landscape in New Orleans, it’s beneficial to compare offers from different lenders. Shopping around can reveal a range of interest rates and terms, and a slight difference in rate can lead to substantial savings over the life of the loan. It’s advisable to consult with local lenders who are familiar with the New Orleans market dynamics, as they can provide insights tailored to this distinctive environment.

In conclusion, securing an optimal mortgage rate in New Orleans requires a blend of research, financial readiness, and strategic decision-making. By understanding the local and national economic factors, evaluating personal financial health, and consulting with knowledgeable local professionals, prospective homeowners can navigate this complex process with confidence. Embracing these best practices not only ensures a sound financial investment but also a rewarding step into the vibrant lifestyle that New Orleans promises. https://www.usbank.com/home-loans/mortgage/mortgage-rates/louisiana.html

Get answers to frequently asked questions about mortgage rates. What is a good ... https://www.bankrate.com/mortgages/mortgage-rates/louisiana/

As of Friday, March 28, 2025, current mortgage interest rates In Louisiana are 0.00% for a 30-year fixed mortgage and 0.00% for a 15-year fixed mortgage. https://www.nerdwallet.com/mortgages/mortgage-rates/louisiana/new-orleans

Today's mortgage rates in New Orleans, LA are 6.858% for a 30-year fixed, 5.975% for a 15-year fixed, and 7.015% for a 5-year adjustable-rate ...

|

|---|